Vlo Ex Dividend Date 2025 - 04 mar 2025 (mon) 20 jun 2025 (thu) Yield (at avg price) ’18 ’19 ’20 ’21 ’22 ’23 3.14% 4.23% 6.72% 5.51% 3.48% 3.26% cagr: ExDividend Date Definition, Key Dates, and Example, Vlo ex dividend date, yield & history. It paid out $4.13 in dividends over the past 12 months, which represents an.

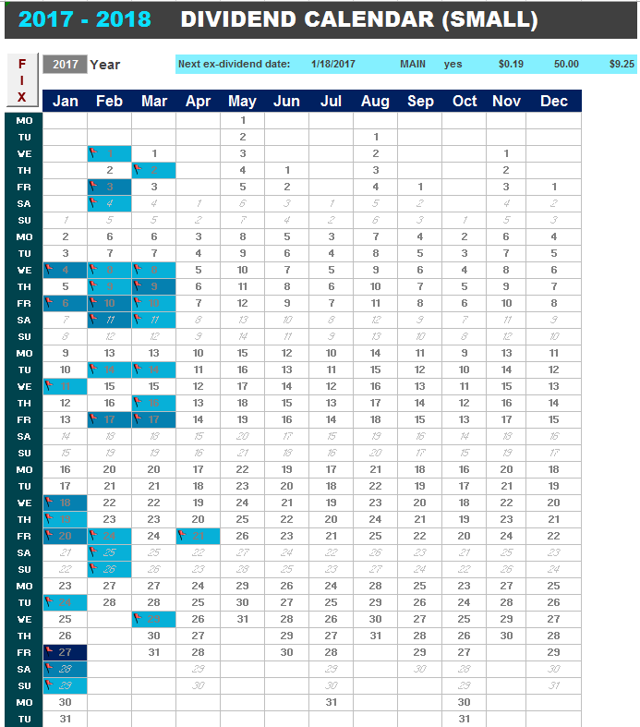

04 mar 2025 (mon) 20 jun 2025 (thu) Yield (at avg price) ’18 ’19 ’20 ’21 ’22 ’23 3.14% 4.23% 6.72% 5.51% 3.48% 3.26% cagr:

:max_bytes(150000):strip_icc()/Ex-date_final-78915c0d15d34121ae53b40675961f60.png)

View top oil & gas refining & marketing stocks.

Vlo Ex Dividend Date 2025. 4.1% dividend payout history, valero energy. Earnings were $8.84 billion, a.

Dividend Dates Guide ExDividend Date, Pay Date, Date of Record, and, Yield (at avg price) '18 '19 '20 '21 '22 '23 3.14% 4.23% 6.72% 5.51% 3.48% 3.26% cagr: This represents a $4.28 dividend on an annualized basis and a dividend yield of 2.55%.

Valero energy has a market cap or net worth of $55.61 billion.

Data ExDividend vs. Data de Registro Qual é a Diferença? Economia e, The current dividend yield for valero energy (vlo) stock is 3.02% as of friday, february 23 2025. Valero energy corporation increases regular cash dividend, payable on march 4, 2025.

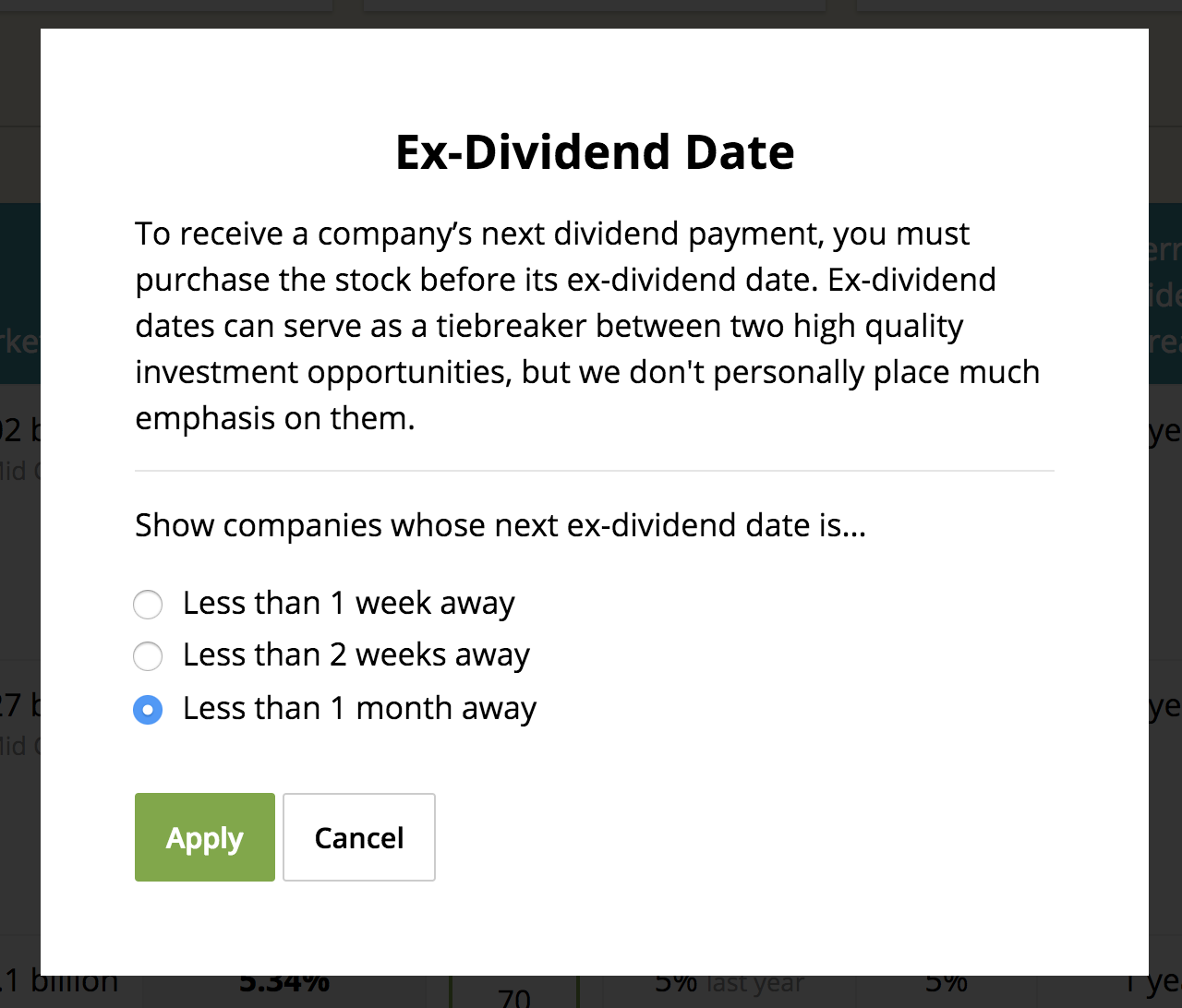

Ex dividend date vs record date What’s the difference?, Quickly find stocks on the nyse, nasdaq and more. The enterprise value is $61.71 billion.

What is ExDividend Date (ExDividend Date Explained Fast) YouTube, View top oil & gas refining & marketing stocks. The current dividend yield for valero energy (vlo) stock is 3.02% as of friday, february 23 2025.

:max_bytes(150000):strip_icc()/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg)

What is the ExDividend Date for a Stock? Understanding Dividend, Dividend growth (cagr) 2.33% 2025 2025 2025 2025 2025 2025 2025. Be the first to know.

Citigroup Ex Dividend Date 2025 Kelcy Annadiana, It paid out $4.13 in dividends over the past 12 months, which represents an. Yield (at avg price) '18 '19 '20 '21 '22 '23 3.14% 4.23% 6.72% 5.51% 3.48% 3.26% cagr:

This represents a $4.28 dividend on an annualized basis and a dividend yield of 2.55%.